400 K Street NE, now undergoing renovation, after at least 24 years of being vacant.

In weak real estate markets, disinvestment is a real problem, and you have few tools at your disposal to turn places around, because investments in reconstruction of properties, and extranormal investments in multi-decade disinvested properties, don't necessarily come back in significantly increased property value.

This is something that I didn't really appreciate for a long time. E.g., you can invest $100,000 or more in a "historic" (designated or not) house in many DC neighborhoods and the property value will increase by two or more times the cost.

In a place like Cleveland or Cincinnati or Rochester, NY, you can spend $100,000 for a house that would cost 5-7 times more than that in DC, but the investment in fixing it up, say $100,000 to $200,000, could take decades to come back in terms of increased value of the property ("return on investment"). So from the standpoint of economics, it doesn't make sense to make such an investment. When it's done, it's done for "noneconomic" reasons.

This is hard for many people to understand with regard to DC, because they are relatively new to the city. (But even in the bad years, the DC preservation community never really developed an array of tools and programs designed to assist homeowners in rehabilitating properties. Here it's mostly been a ground-up effort. Only in the past few years, has a tax credit program for homeowners been put in place, targeting certain disinvested neighborhoods.)

Up into the middle part of the last decade, many neighborhoods, especially commercial districts, suffered significantly from vacant properties. Of course, much of this was generated by the riots after the assassination of Martin Luther King and the abandonment that resulted.

For example, in my old H St. neighborhood, which I moved into first in September 1987, I can think of three of my favorite buildings--one is still vacant since then, and the other two have only been started to be rehabilitated in the last 18 months--and who knows how long the buildings were vacant before 1987.

The

City Paper Housing Complex blog has a great piece, "

No vacancies: how nuisance properties turn around," on Reuben Pemberton, who runs the Vacant Buildings Unit for the Dept. of Consumer and Regulatory Affairs. Mr. Pemberton appears to be an "odd duck" as far as DCRA is concerned, because according to the article, his focus is on using the vacant buildings tax penalties (in DC, vacant buildings are taxed at a much higher rate) as a fulcrum to get buildings back into productive use.

In my experience, other units of DCRA haven't focused on maintaining qualities of place so much as they have been on "immediate eradication of the nuisance," which for the most part, just creates a new nuisance. E.g., a nuisance building that gets demolished then just becomes a nuisance lot, but that much harder and more expensive to redevelop.

I used to testify about this quite a bit, from around 2002 to 2006 (e.g., "

Why I hate DC" or the appropriate tactical strategy to apply to nuisance properties/ disinvestment is investment, not demolition"). Now, as the city continues to attract new residents ("

Census: DC adds 16,000 new people" from the

Post), this problem seems to be working its way out.

It's much harder in weak market cities, much harder, which is why programs from organizations like the

Center for Community Progress are so important. (Their national conference is next month.)

Bringing Buildings Back by Alan Mallach covers the process very well also. As Alan points out, the issue really comes down to making locations valuable again, so that there is demand for what are otherwise vacant buildings. According to

Rolf Goetze, buildings in the center city became vacant through overproduction of suburban housing, and outmigration from the cities to those properties.

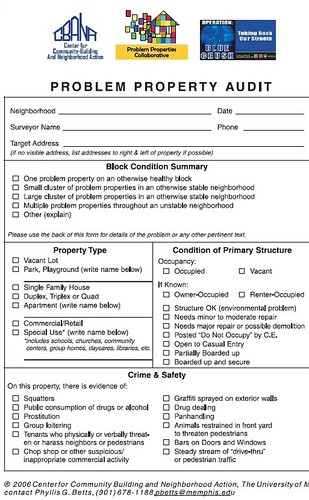

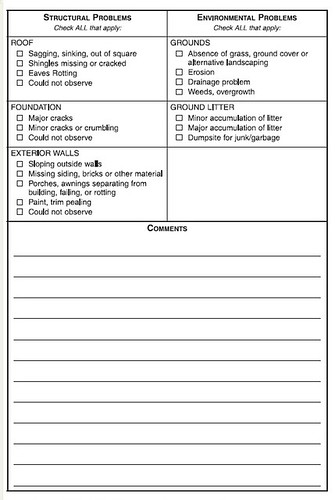

One thing that cities can do, is provide more tools to neighborhoods so that they can get a handle on vacant properties languishing within their communities. For example, I am fond of the Problem Property Audit survey form from the University of Memphis. I don't think that this kind of information is made available on a neighborhood by neighborhood basis in DC or in most cities.

Getting the tax policy right is really important. In other places, like Ontario ("

Guelph forum to investigate demolition-by-neglect" from the

Guelph Mercury; note that the article is very good in describing the general problem of vacant properties and how to rehabilitate them) and in the UK, if a property is empty, the property taxes can be reduced. This seems to me to be a nonsensical policy, as it is a disincentive to improving neighborhoods, even though the opposite is claimed by landlords. On the other hand, in weak markets, it can reduce the pressure to demolish otherwise "worthless" buildings, preserving the option and opportunity for renovation at some point in the future.

--

Toronto Property Tax Rebate Program for Vacant Commercial and Industrial Buildings (it's actually a Ontario provincial law)

Another strategy, "receivership," is discussed in the testimony cited above.

Labels: building regulation, code enforcement, commercial district revitalization planning, historic preservation, receivership, urban design/placemaking, urban revitalization

0 Comments:

Post a Comment

<< Home